XT NIFTY 50

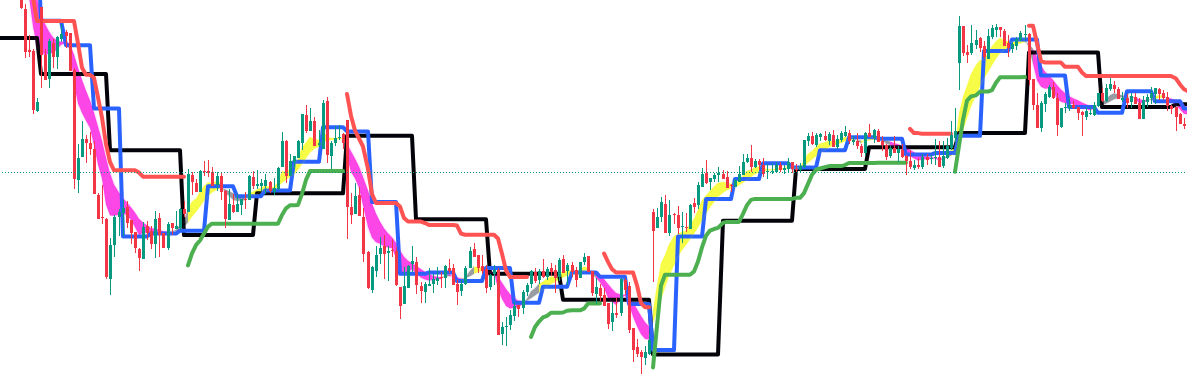

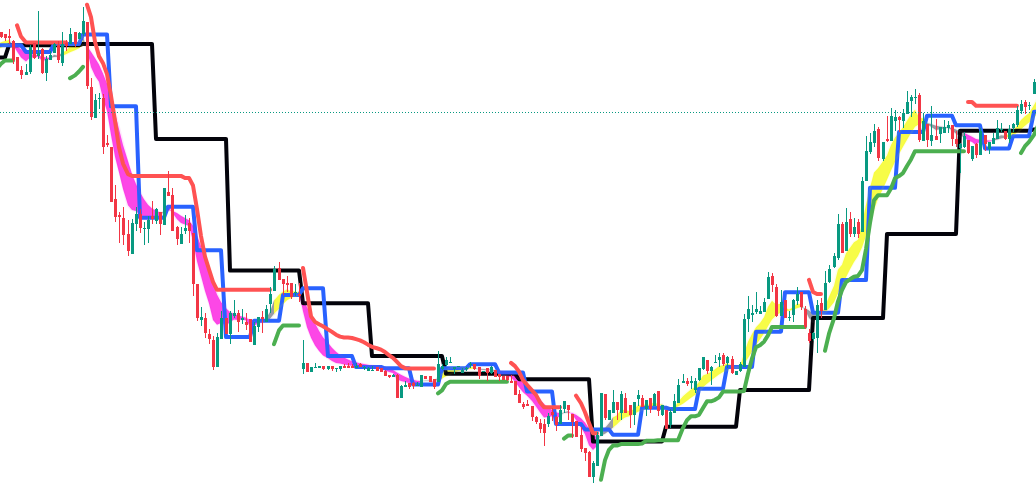

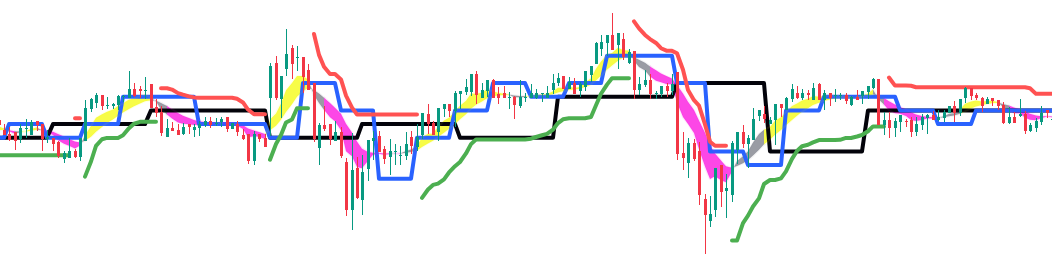

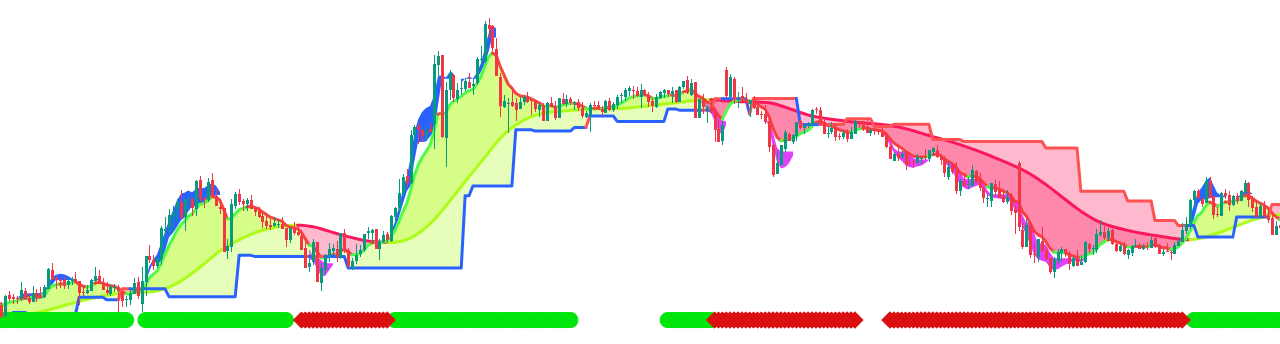

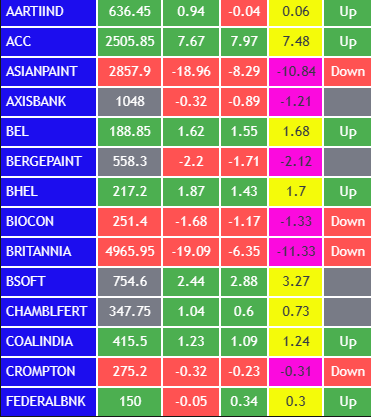

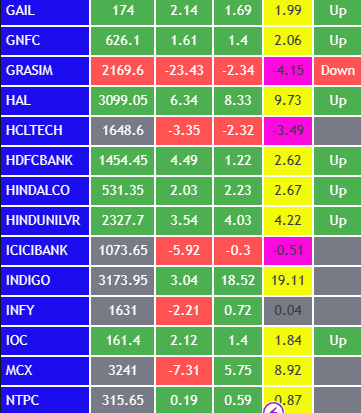

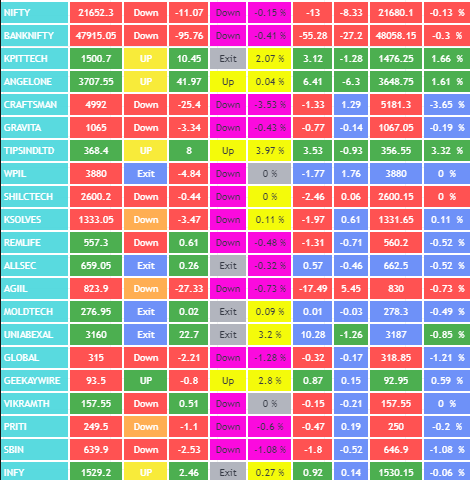

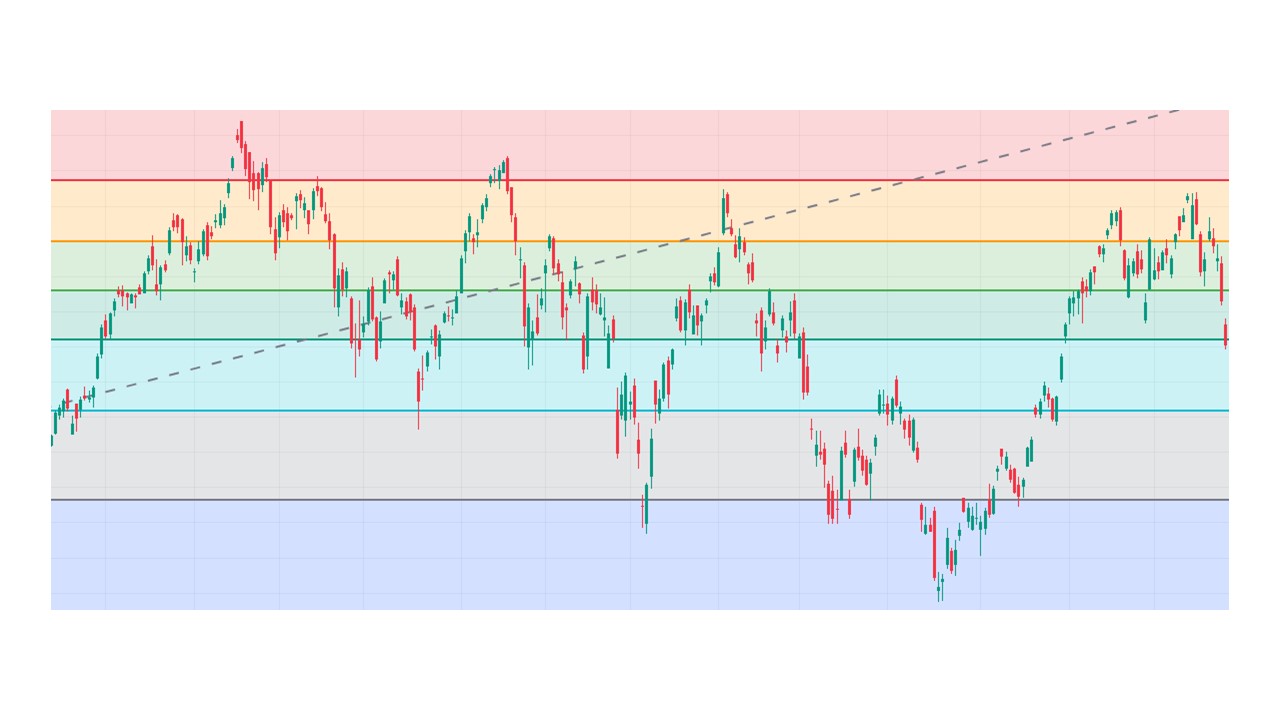

This is an ALGO(Automatic) trading strategy for Intraday players to trade in Nifty 50.

It will take trade at 9.20 AM and closes all active trade on the same day at 3.25 PM NSE times. In between it will switch the trades CALL to PUT or Vice-Versa as per the movement of the market.

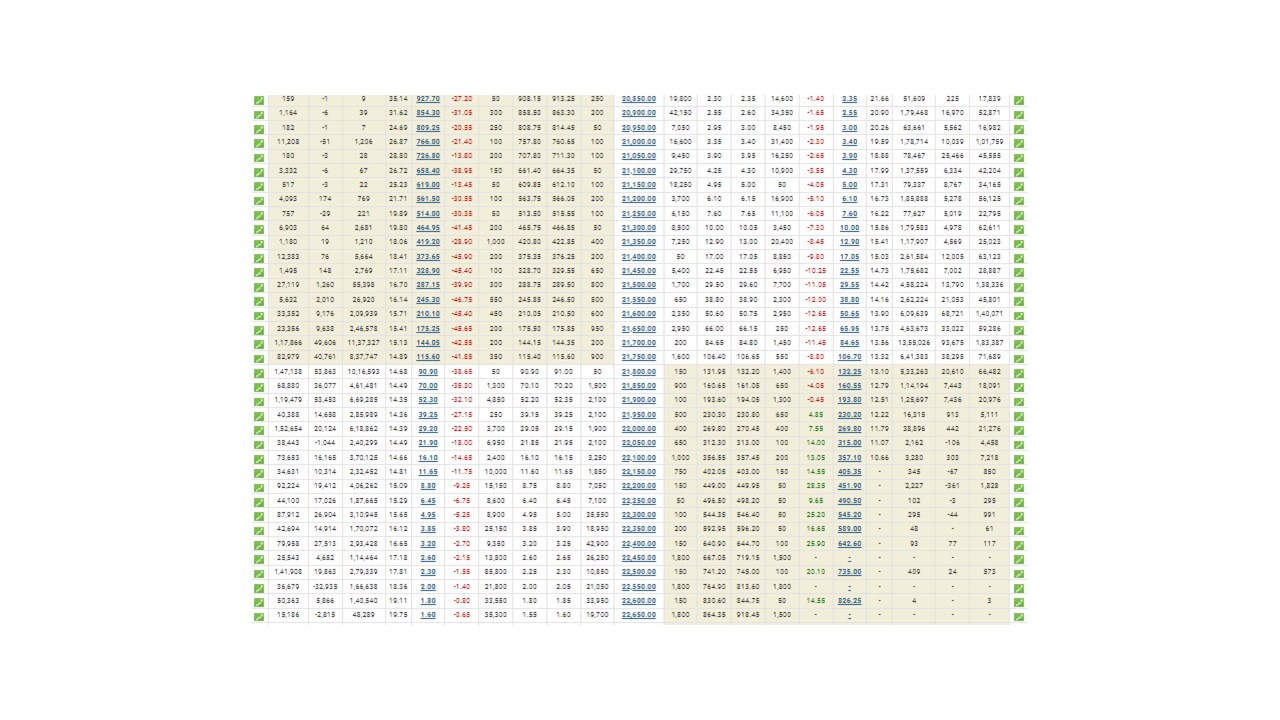

It takes One Lot of CALL or PUT at the ATM for Weekly Expiry of Nifty 50. If someone willing for more than one lot then they can use multiplier for the same but remember required fund will also increase as per the multiplier. Maximum multiplier allowed at present is 5X.

If today is weekly expiry of the Instrument it won't take trade of that particular Instrument.

Once the trading hours are over OR universal exit happens, it gets reactivated on its own after 15min (If you want to take more risk you can reactivate or Pause by yourself at your own risk), hence its ready again to take trades once the market is open.

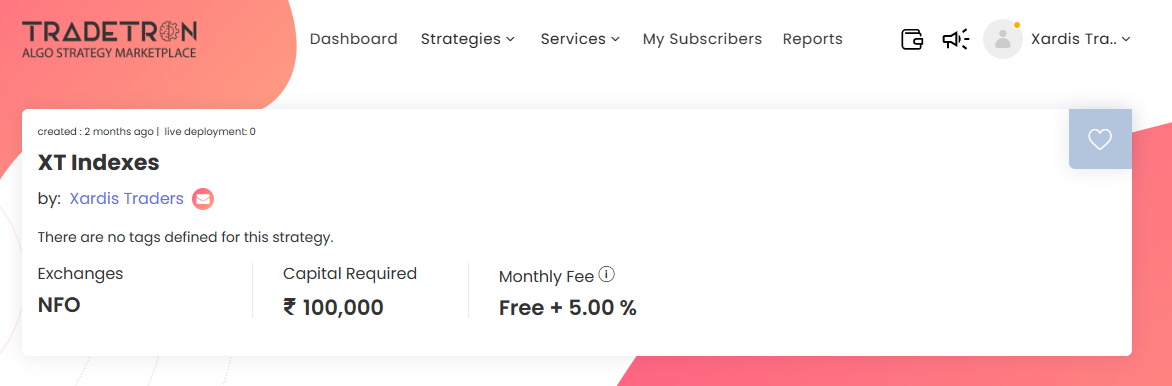

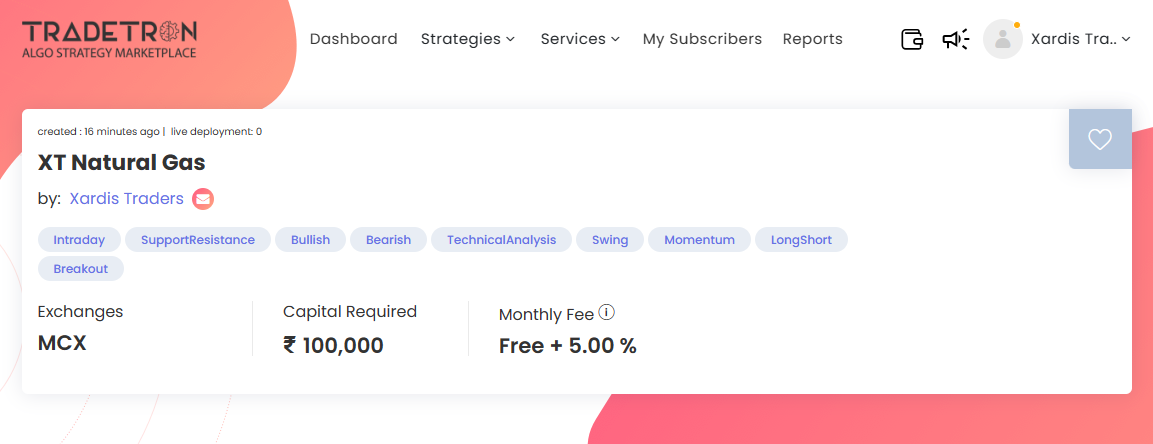

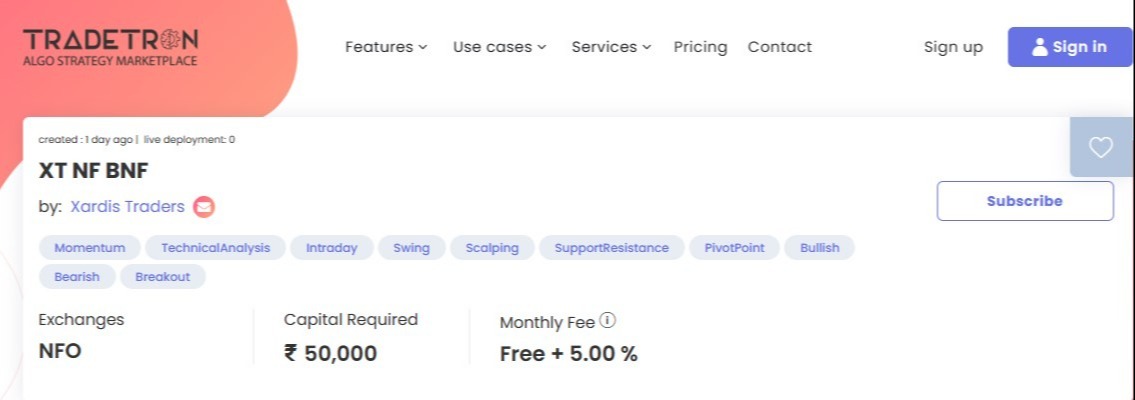

To Subscribe to this strategy please click following Link:

· Subscription is Free.

· Monthly charges will be 5% of the total profit made.

· Capital required is INR 10,000

· Invoice will be generated first week of every month.

Warning:

· Trading in options is a very high-risk trading.

· As per SEBI study, 9/10 individual traders in option segments incurred losses.

· Almost traders loose around Rs 50,000/- in option segment trading’s.

· Over & above net loss traders also incurred 28% of net trading losses as transaction cost.

· Those making profit, loose around 15% to 50% of such profit as transaction cost.